Comparing Tangerine Money Back Versus World Mastercard Credit Card

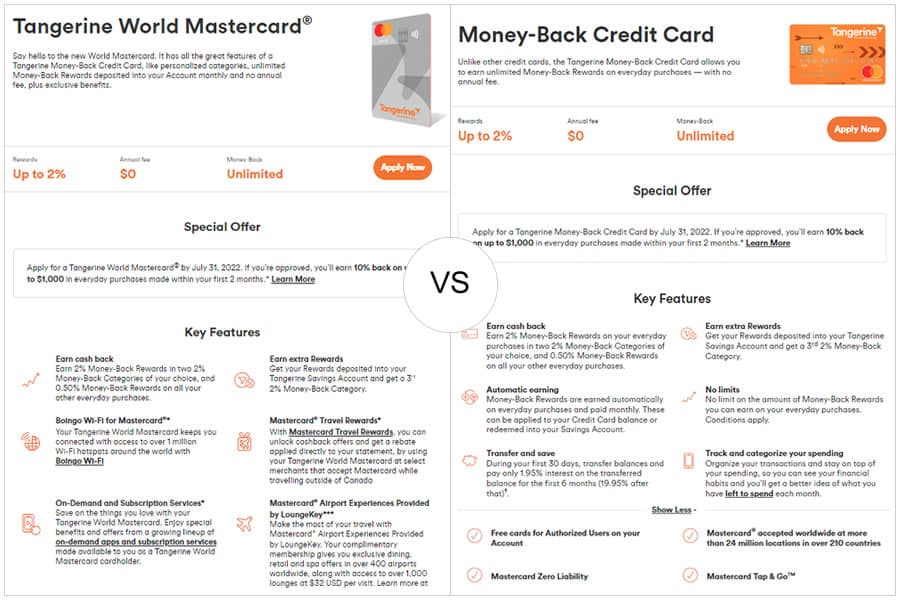

If you’re a regular Tangerine client, you might have had the pleasure of receiving a notification that you can upgrade your old Tangerine Money-Back to the brand new and improved Tangerine World Mastercard. Both of these cards are issued by Tangerine, with the World being the new and improved version of the standard Money-Back. While it does have an intricate set of benefits and improvements over the classic, it also changes quite a few things quite significantly, which might not be for everyone. See the detailed Tangerine World vs Money-Back Mastercard comparison below.

- Money-Back by Tangerine – is best for those with lower credit scores and a gross annual income of 12,000 or more.

- World Mastercard by Tangerine – is best for applicants with credit scores above 740 who have 60,000 or more gross annual income and are looking for bonus World card features.

- Comparing Tangerine Money Back Versus World Mastercard Credit Card

- World vs Money Back Credit Card Comparison Table

- What Are the Tangerine Credit Cards?

- What Is Tangerine Money-Back Credit Card?

- What is Tangerine World Credit Card?

- Tangerine World vs Money Back – Which is Better?

- Tangerine Cards Alternatives and Competition

- Bottom Line

World vs Money Back Credit Card Comparison Table

| Tangerine World | Tangerine Money Back | |

|---|---|---|

| Ongoing APR | 19.95% | 19.95% |

| Annual Fee | $0 | $0 |

| Credit Needed | 740 or more | 670 or more |

| Intro APR | 1.95% | 1.95% |

| Applied to | Balance Transfers | Balance Transfers |

| Intro APR Period | 6 months | 6 months |

| Cash Back Rewards | up to 2% | up to 2% |

| Special Offer (Limited time) | 10% back* on everyday purchases | 10% back* on everyday purchases |

| 2% Categories | 10 | 10 |

| Money-Back | Unlimited | Unlimited |

| Key Features | Transfer and save Automatic earning Free Supplementary Cards Mastercard Zero Liability Mastercard Tap & GoTM | Transfer and save Automatic earning Free Supplementary Cards Mastercard Zero Liability Mastercard Tap & GoTM |

| Bonus Features | Boingo Wi-Fi for Mastercard Mastercard® Travel Rewards On-Demand & Subscription Services Rental Car Collision Insurance Rentals Card Loss Damage Insurance Mobile Device Insurance Mastercard® Airport Experiences* | n/a |

| Eligibility Requirements | Applicants must meet one of the following: – gross annual income of $60,000 or more – gross household income of $100,000 or more – balances of $250,000+ in Tangerine Savings – balances of $250,000+ in Investment Fund | – gross annual income of $12,000 or more |

| Additional Requirements | – The age of majority in your province or territory – Permanent resident of Canada – No bankruptcies for 7 years | – The age of majority in your province or territory – Permanent resident of Canada – No bankruptcies for 7 years |

| Reviews | Tangerine World Card Review | |

| More information | Tangerine World Mastercard | Tangerine Money-Back Mastercard |

| Claim This Offer | Claim This Offer |

What Are the Tangerine Credit Cards?

The Tangerine range is one of the most popular credit card types in Canada. These cards have been around for a while, and all of the Tangerine selection cards are known for their customer-orientated features, relative affordability, and fantastic customer support. As of writing this article, Tangerine offers multiple financial services, but two spending cards are what most consumers are looking for: the Tangerine World and the Tangerine Money-Back cards, respectively.

Are Tangerine Mastercards Any Good?

Both of these cards are renowned for their affordability, money-saving potential, and their applicability. The Tangerine World and the Tangerine Money back are both based on the Mastercard platform, which is the second most popular credit card platform and is viable in over 210 countries worldwide. For 22 countries, it’s even more popular than VISA. Both of these cards are very, very similar, and share quite a lot of features. The Tangerine World is a bit more feature-rich than the standard Money-Back, but it’s also slightly more complicated and has more rigorous minimal requirements.

How Do I Apply For Tangerine Cards?

Both of these cards have a straightforward, streamlined, and direct application process. As long as you fit the card’s minimal requirements, you need not even visit a physical location, as you can do all of your applications on the internet.

What Is Tangerine Money-Back Credit Card?

The Tangerine Money Back Mastercard is the ole reliable in Tangerine’s credit card arsenal. It’s the oldest out of the two, and it has been the community favorite for quite a long time, and that’s mostly due to its many customer-oriented features. This card is simple to use, effortless to manage, and you don’t need to fit any high sky criteria to get accepted for a card like this.

It also allows you to get limitless cashback and other rewards on everyday purchases such as gas, groceries, and all kinds of different things. This card has no annual fee, making it a fantastic option for everyone looking to open a long-term card that they won’t need to close down once it becomes obsolete.

What Are the Features of the Money back Card?

This is one of the most feature-filled cards currently on the Canadian market. Aside from this card’s relatively low costs, you can get Money back on almost all everyday shopping and spending in restaurants, supermarkets, hotels, and even for entertainment such as movies. You can pick three of these categories for your 2% cash back on every purchase, allowing you to make it your own. It’s one of the best-rounded cards for consumers looking for a card that fits their unique lifestyle. One of the more exciting features of this card is that it fully supports third-party payment wallets, such as Google Pay, Apple Pay, and even Samsung Pay.

Are There Benefits or Any Disadvantages of Money-Back Card?

One of the most notable benefits of this card is its outstanding simplicity. Almost every single aspect of using and managing this card is as simple as can be. You get an easy to use mobile app or an equally easy to navigate website which you can use to manage your finances at all times. It’s really helpful for people who are looking to maximize their cash back, all while getting an elementary, non-invasive card in their pocket.

Where this card falls off is its surprising lack of unique features. Sure, cashback is fantastic, but this card doesn’t go far from its original idea. There aren’t many insurance types; there aren’t any unique qualities – it’s relatively plain. While on the topic of cashback, unlike most credit cards, this one operates monthly rather than yearly, so you can get your return once a month at the end of each cycle, so you don’t have to wait for that once-a-year payment.

What Are the Requirements and Costs?

Lastly, what we like about this card are its minimum income requirements. Other cards with similar benefits might require up to $80k annually, while this one only requires $12k, meaning it’s an ideal card for young people who are only working part-time jobs or people who are working on a side hustle. The costs are equally as low. There are no annual fees associated with this card. The APR is relatively low, and other fees are also very tolerable, lower to the mid-range than the competition.

What is Tangerine World Credit Card?

The Tangerine World Mastercard is the second and most recent addition to Tangerine’s range of credit cards. It’s everything that the money-back card is, but bigger and more flexible. That does come at a price, though, as the World Mastercard has higher requirements and some higher fees, but the potential it brings to the table makes it worth the extra trouble. Like its predecessor, the Money-Back card, the Tangerine World doesn’t have any annual fees and is customer orientated card that puts you ahead of banks, and just like the Money-Back, it supports Apple pay, Google pay, and Samsung pay too. It’s a feature-filled little card that gives you fantastic capabilities and purchasing power while being surprisingly low-demand. Sure, you have to fill more requirements to meet the minimum criteria, but the exclusive benefits and features are well worth it.

What Are the Features of the World Mastercard?

To start the list of features, we have to pay attention to the cashback, which works similarly to the one found in the Money-Back card, but instead of three categories, you get two. Now, this is a trade-off that’s more than worth your time, as you get a selection of other things instead. One such thing is the free Wi-Fi. Mastercard connects you with Boingo Wi-Fi on over a million locations all across the World for no added costs or fees.

Aside from the free Wi-Fi, you become eligible for the many delightful Mastercard travel rewards, which can save you quite a lot of money the next time you’re travelling. You can get quite many perks with streaming platforms and entertainment if you use this card, as Tangerine World has some exclusive benefits with top services across the globe. Aside from all of the Mastercard gold benefits, you get some Tangerine exclusives, such as extended warranty, limited liability insurance, phone insurance, and even rental car insurance. Many, many more features of this card only add to its appeal, but none are quite as important as the limitless 2% cashback on all purchases.

Are There Benefits or Any Disadvantages of World Mastercard?

- Tangerine World is a solid and easy-to-use card. Tangerine themselves have a distinctive way of helping you use and manage your finances so you can maximize your financial wellness. If you ever come across an issue, the fantastic customer service is there for you.

- Unlike the Money-Back, the World has fantastic benefits and features that help you do virtually anything, but most importantly help you when you’re travelling. You get all of the Mastercard gold benefits, as well as things that make the card more convenient to use, such as the pause my card feature, which allows you to suspend it temporarily.

- The only disadvantage with these cards is their minimum requirements, which are far higher than those of the Money-Back card.

- It’s a slick, reliable, and very well-thought-out personal finance tool that will undoubtedly fill any void in your wallet with a useful, easy to use, and feature-filled credit card.

What Are the Requirements and Costs?

Now, this is where this card tends to fall a bit off. While the Money-Back requires a personal income of only $12k annually, the World requires a minimum of $60k, which is five times as much. But, for this amount, you do get quite a lot of features and benefits. Like with the Money-Back, the general fees and costs are relatively low, the APR is up to industry standard, and there is no annual fee.

Tangerine World vs Money Back – Which is Better?

This is a troublesome question, as both are good in their own right. We like the Tangerine World quite a lot because of its many features, and we like the Money-Back due to its relative simplicity. The best option for you would be the one that fulfills your personal needs the best. If you don’t have a huge cash flow and are just looking to upgrade your card to get some great cashback features or even stack it with another card, the Money-Back is going to do the job perfectly. However, if you’re, looking for a more rounded and feature-filled option that gives you many exclusive benefits, you might want to opt for a Tangerine World Mastercard.

Tangerine Cards Alternatives and Competition

| Offer | Annual Fee | Rewards | Bonus | Application |

|---|---|---|---|---|

| Scotiabank Gold American Express | See terms | Up to 5 Scotia Rewards | 25,000 bonus Rewards | Claim this offer |

| No-Fee Scotia Momentum Visa | $0 | 1% cash back | 7.99% for 6 months on Purchases | Claim this offer |

| Neo Financial Rewards Mastercard | $0 | Up to 5% cash back | 15%, $25 bonus | Claim this offer |

| Scotiabank Value Visa | $29 | – | 0.99% for 6 months on BT | Claim this offer |

| Walmart Rewards World Mastercard | $0 | Up to 3% cashback | $25 Rewards Dollars | Claim this offer |

Bottom Line

Both Tangerine cards are fantastic offers that will serve you right. They’re issued by one of Canada’s favorite companies, and they have a well-substantiated reputation for many Canadians. These cards are going to put you and your needs above all else, so you can rest assured knowing that you’re in good hands when you’re banking with Tangerine. If you want or need the bonus features and have a minimum annual gross income of $60,000 or more – go for Tangerine World Mastercard, otherwise, choose Tangerine Money-back.